You Can Still Get Student Loan Forgiveness in These States Even if Biden’s Debt Plan Fails in 2023

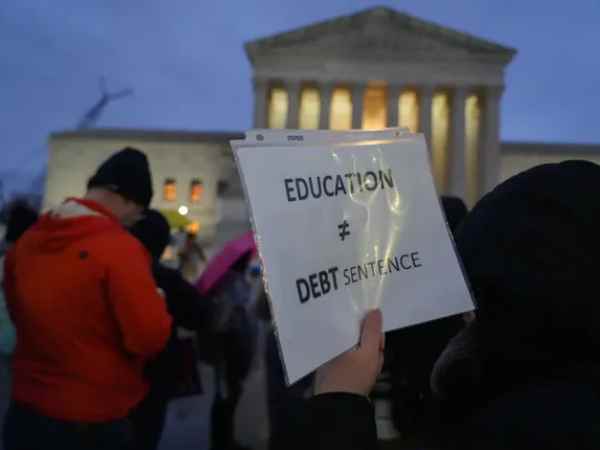

The ever-increasing student loan debt has been a major concern for millions of Americans, and President Biden’s plan to provide student loan forgiveness has given hope to many. However, with the current political climate and uncertainty surrounding the future of the proposal, it’s understandable if you’re feeling anxious about your loans. But did you know that there are five states in the US where you can still get student loan forgiveness even if Biden’s debt plan fails? In this blog post, we’ll explore these states and how you can take advantage of their programs to ease your financial burden. So let’s dive in!

What is Student Loan Forgiveness?

Student loan forgiveness is a program that allows borrowers to have some or all of their student debt canceled, depending on certain eligibility criteria. It’s a way for the government or other institutions to help people who are struggling with their loans, either because of high-interest rates or financial hardship.

There are several types of student loan forgiveness programs available, including public service loan forgiveness and teacher loan forgiveness. These programs usually require you to work in specific fields for a certain amount of time before your debt can be forgiven.

It’s important to note that not everyone qualifies for student loan forgiveness. Eligibility requirements vary depending on the program, but generally, you need to have federal loans and meet specific income and employment requirements.

If you’re considering applying for student loan forgiveness, it’s crucial that you do your research and understands the application process thoroughly. You should also consider consulting with a financial advisor or counselor who can help guide you through the process.

While it may seem like an attractive option for those struggling with student debt, it’s important to remember that not everyone will qualify for these programs and they may not always be guaranteed in uncertain political times such as now under Biden’s proposal uncertainty.

What are the requirements for student loan forgiveness?

Student loan forgiveness is a program that helps borrowers get rid of their student debt. However, not everyone can qualify for it. There are certain requirements that you need to meet before your loans can be forgiven.

Firstly, you must work in a qualifying public service job or non-profit organization for at least ten years. You also need to make 120 on-time payments towards your federal student loans while working in the public sector.

Secondly, if you’re looking to get your loans forgiven through income-driven repayment plans, there are different requirements depending on the plan you choose. Generally, these plans require you to have partial financial hardship and repayments based on your income.

Thirdly, some states have their own student loan forgiveness programs with specific eligibility criteria such as living and working within the state’s borders or having certain professions like healthcare workers or education professionals.

In short, each type of student loan forgiveness has its unique set of qualifications that borrowers need to meet. It’s essential to do thorough research and understand all the requirements before applying for any program.

Also Raed – Bud Shuster, congressional ‘King of Asphalt,’ dies at 91

The five states that offer student loan forgiveness

For those struggling with student loan debt, there is hope. Several states in the U.

S. offer programs that can provide partial or full forgiveness of your student loans. These programs are often geared towards individuals who work in public service fields, such as teaching or social work.

The first state to consider is Maryland, which offers a variety of loan repayment and forgiveness programs for graduates working in certain fields. For example, the Janet L. Hoffman Loan Assistance Repayment Program provides assistance to law school graduates who take on public service jobs.

Another great option is Delaware’s Higher Education Office program which forgives up to $10,000 a year for five years for eligible borrowers. This program helps many students pay off their loans while they work at an approved nonprofit organization.

Next up is New York State’s Get On Your Feet Loan Forgiveness Program which offers recent college graduates living in the state some relief from their student loan debt by providing up to two years of federal student loan payments.

Another popular choice among borrowers is California’s Steven M Thompson Physician Corps Loan Repayment Programs where physicians could receive up to $105k worth of aid if they commit 3-year full-time equivalent service obligation practicing primary care medicine at an underserved facility anywhere throughout California

Lastly there’s Texas’ College Access Loan (CAL) Repayment Assistance Program designed specifically for Texans who graduated after May 1st, 2018 with zero credit risk-based interest rate and may qualify them depending on different criteria but not limited to income limits and residency requirements

It’s important that you research what each program has specific eligibility requirements so don’t hesitate to check out your home state website list of available resources today!

Also Raed – All the Celebrities Who Have Attended Taylor Swift’s Eras Tour So Far 2023

How to take advantage of student loan forgiveness

If you’re interested in taking advantage of student loan forgiveness, there are a few steps you can take to ensure that you qualify for the program. First and foremost, it’s important to research which states offer student loan forgiveness and what the specific requirements are.

Once you’ve identified which states may work for you, make sure that your loans are eligible for forgiveness. Some programs only apply to certain types of loans or borrowers who meet specific criteria.

It’s also critical to stay up-to-date on any changes or updates made by the government regarding national debt relief programs. This information can be found online through various news outlets and official government websites.

To apply for student loan forgiveness, you’ll likely need to submit an application along with supporting documentation such as proof of income or employment status. Make sure that all forms are filled out accurately and completely before submitting them.

Be patient throughout the process. It may take several weeks or even months before your application is reviewed and approved. In some cases, it may be helpful to seek assistance from a financial advisor or counselor who specializes in student loan debt relief programs.

By following these tips and staying informed about available options, you can increase your chances of successfully taking advantage of student loan forgiveness opportunities in your state.

What Kinds of Student Loan Forgiveness Plans do States Offer

Each state may offer different student loan forgiveness plans for residents. Here are some examples:

- 1. Teacher Loan Forgiveness Program: This program is available to teachers who have worked full-time in a low-income school or educational service agency for five consecutive years.

- 2. Health Care Professional Loan Forgiveness Program: This program is available to healthcare professionals who work in underserved areas and agree to work there for a certain number of years.

- 3. Public Service Loan Forgiveness Program: This program is available to government or non-profit employees who make regular payments on their loans for 10 years while working full-time.

- 4. Military Loan Forgiveness: This program is available to members of the armed forces and National Guard who have served in hazardous duty areas.

- 5. State-Specific Programs: Some states may offer their own student loan forgiveness programs, such as Missouri’s “Wartime Veteran’s Survivors Grant” or Alaska’s “Alaska Teacher Education Loan Repayment Program”.

It is important to note that eligibility requirements vary by program and state, and individuals should research the specific requirements before applying.

Maryland Student Loan Forgiveness Programs

Sure, here are some examples of student loan forgiveness programs that are available in Maryland:

- 1. Janet L. Hoffman Loan Assistance Repayment Program: This program is available to attorneys who work for a qualifying employer in Maryland and have outstanding law school loans.

- 2. John R. Justice Student Loan Repayment Program: This program is available to public defenders and prosecutors who work in Maryland and have eligible federal student loans.

- 3. Maryland SmartBuy Student Loan Debt Relief Program: This program is available to homebuyers in Maryland who have student loan debt and meet certain requirements, such as purchasing a home in a target area and having a household income below a certain level.

- 4. Maryland Dent-Care Loan Assistance Repayment Program: This program is available to dentists who work for a qualifying employer in Maryland and have eligible dental education loans.

- 5. The Veterans of the Afghanistan and Iraq Conflicts Scholarship: This program offers financial assistance to Maryland residents who served in the military in Afghanistan or Iraq and their family members.

It is important to note that eligibility requirements vary by program, and individuals should research the specific requirements before applying.

New York Student Loan Forgiveness Programs

Sure, here are some examples of student loan forgiveness programs that are available in New York:

- 1. New York State Get on Your Feet Loan Forgiveness Program: This program is available to New York residents who earned an undergraduate degree from a college or university located in New York, have incomes below a certain level, and are enrolled in an income-driven repayment plan.

- 2. New York State Licensed Social Worker Loan Forgiveness Program: This program is available to licensed social workers in New York who work in a qualifying public or non-profit agency.

- 3. New York State Young Farmers Loan Forgiveness Incentive Program: This program is available to farmers in New York who are in their first ten years of farming and have student loan debt.

- 4. New York State Nursing Faculty Loan Forgiveness Incentive Program: This program is available to nursing faculty members in New York who have eligible student loan debt and work in a qualifying institution.

- 5. New York State Math and Science Teaching Incentive Program: This program is available to teachers in New York who hold a math or science degree and teach in a secondary school.

It is important to note that eligibility requirements vary by program, and individuals should research the specific requirements before applying.

Kansas student loan forgiveness programs

Sure, here are some examples of student loan forgiveness programs that are available in Kansas:

- 1. Rural Opportunity Zones (ROZ) Student Loan Repayment Program: This program is available to individuals who move to one of the designated counties in Kansas and have qualifying student loan debt.

- 2. Kansas State Loan Repayment Program: This program is available to healthcare providers who agree to practice in a designated underserved area for a certain period of time.

- 3. Kansas Teacher Service Scholarship: This program is available to Kansas high school students and college students who are planning to become teachers in Kansas.

- 4. Kansas Military Service Scholarship: This program is available to Kansas National Guard members who attend a Kansas postsecondary institution.

- 5. Kansas Comprehensive Grant: This program provides need-based grants to eligible Kansas residents who attend a Kansas college or university.

It is important to note that eligibility requirements vary by program, and individuals should research the specific requirements before applying.

Conclusion

Although President Biden’s student loan forgiveness plan is still up in the air, it doesn’t mean that borrowers can’t take advantage of other options. If you reside in one of the five states mentioned above or plan to pursue a career path that may qualify for loan forgiveness, don’t hesitate to explore those opportunities.

Remember, whether you’re seeking financial assistance or not, always make timely payments on your loans and stay informed about any changes in policy. With a little research and diligence, you can successfully navigate the world of student loans and pave the way toward a debt-free future.