First Republic Bank in Limbo as US Regulators Juggle Bank’s Fate

The First Republic Bank is one of the oldest and most respected financial institutions in the United States. Founded in 1985, the bank has grown to become one of the largest and most successful private banks in the country, with over 80 offices across the US. However, recent events have put the bank’s future in jeopardy, as US regulators struggle to decide the bank’s fate. This article explores the current situation surrounding First Republic Bank and the potential outcomes for the bank and its customers.

Introduction

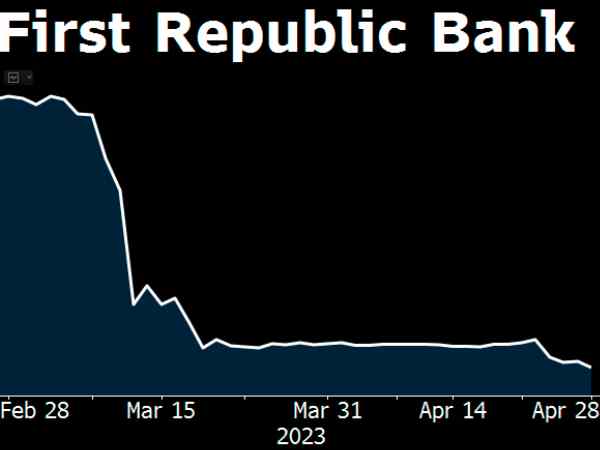

In May 2023, the US financial industry was shaken by the news that the First Republic Bank was in limbo. The bank had been under investigation by US regulators for several months, and it was unclear what the outcome of the investigation would be. The news sent shockwaves through the industry, with many analysts speculating about the future of the bank and its customers.

The History of First Republic Bank

First Republic Bank was founded in 1985 by Jim Herbert, a former Wells Fargo executive. The bank began as a small institution with just one office in San Francisco. However, it quickly grew in popularity due to its high-quality customer service and personalized banking options. By the mid-1990s, the bank had expanded to include several offices across California.

Over the years, First Republic Bank continued to grow, expanding its reach to include offices in several other states. In 2007, the bank went public, becoming one of the largest and most successful private banks in the United States.

The Investigation

In late 2022, the US government launched an investigation into First Republic Bank. The investigation was prompted by allegations of fraud and illegal activity within the bank. Specifically, the investigation focused on the bank’s lending practices and its relationships with certain clients.

The investigation has been ongoing for several months, with regulators closely scrutinizing the bank’s operations and financial records. While the investigation is still ongoing, there are concerns that the bank may be forced to pay substantial fines or face other penalties.

Potential Outcomes for First Republic Bank

The future of First Republic Bank remains uncertain, as regulators continue to investigate the bank. There are several potential outcomes for the bank, each with its own implications for the bank and its customers.

Scenario 1: The Bank Is Cleared of Wrongdoing

The best-case scenario for First Republic Bank is that it is cleared of any wrongdoing by regulators. In this scenario, the bank would be able to continue its operations without any major disruptions. However, the investigation has already caused significant damage to the bank’s reputation, and it may take some time for the bank to regain the trust of its customers.

Scenario 2: The Bank Is Fined

Another possible outcome for First Republic Bank is that it is fined by regulators. The amount of the fine could be substantial, potentially costing the bank millions of dollars. While the bank would be able to continue operating, a large fine would have significant implications for the bank’s financial health and profitability.

Scenario 3: The Bank Is Forced to Restructure

In the worst-case scenario, regulators may determine that First Republic Bank has engaged in illegal activity and force the bank to restructure. This could involve selling off assets, downsizing operations, or even being forced to shut down completely. This outcome would have major implications for the bank’s customers, who may need to find new banking options.

Also Raed – Breaking News: US Conducts First-Ever Evacuation of Citizens from Sudan War Zone

What This Means for First Republic Bank’s Customers

Regardless of the outcome of the investigation, the uncertainty surrounding First Republic Bank is likely to have an impact on its customers. Customers may be hesitant to continue doing business with the bank, particularly if there are concerns about the bank’s financial health or legal compliance.

For customers who do choose to bank with First Republic, there may be disruptions to their banking services in the event of a major fine or restructuring. Customers may need to find alternative banking options or deal with temporary disruptions to their accounts.

However, it is important to note that the First Republic Bank is a federally insured bank. This means that customers’ deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank. Therefore, even in the worst-case scenario where the bank is forced to shut down, customers will be able to access their funds.

First Republic Bank in Limbo as US Regulators Juggle Bank's Fatehttps://t.co/T1gFlafzkg pic.twitter.com/aSoLtj9RdM

— Pricebala (@Pricebala_) May 1, 2023

Conclusion

The future of the First Republic Bank remains uncertain, as regulators continue to investigate the bank’s operations. While the bank’s customers may be concerned about the potential impact of the investigation on their accounts, it is important to remember that the bank is federally insured, and customer deposits are protected.

Regardless of the outcome of the investigation, the situation underscores the importance of choosing a reputable and financially stable banking institution. Customers should always do their due diligence when selecting a bank, and should regularly review their accounts to ensure their funds are safe and secure.